Are You Covered?

Life, TPD, Income Protection and Trauma

If not, why not? Let us help you to get the cover you need to give yourself the piece of mind that you are insured in case the unimaginable happens.

Gee Fernando & Associates

My name is Gee Fernando and I have been changing the way you buy insurance in Australia since 2012.

I have been in the insurance industry since 2003, as a senior insurance consultant managing clients insurance with yearly reviews and there for clients at the time of claims.

If you are looking for Insurance and you are from another state, do not hesitate to contact me as I provide Insurance for clients Australia wide.

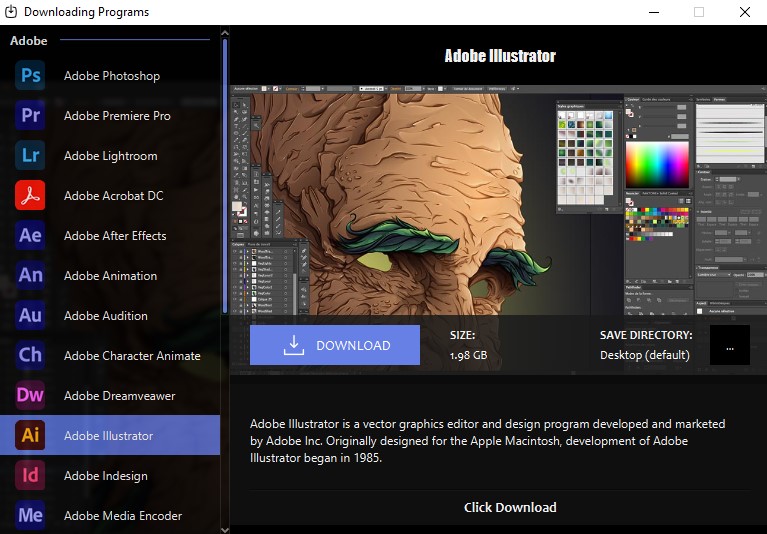

Plan

Life Insurance

Protect

Income Protection

- Protects your ability to earn

- Pay up to 75% of your monthly income

- Premiums can be reduced by selecting a longer waiting period

- Tax deductible

Manage

Business Expense

- Have a financial backup plan for your business

- Keep the business running if you can’t work

- Focus on your recovery – and not your bills

- Insurance to cover your fixed business costs

Why Do I Need Insurance?

What Is best for me?

Know your Policy

Peace of mind

Insurance is a way of managing risks. When you buy insurance, you transfer the cost of a potential loss to the insurance company in exchange for a fee, known as the premium. Insurance companies invest the funds securely, so it can grow and pay out when there’s a claim.

Accidents and disasters can happen at any moment and if you aren’t adequately insured, it could leave you or your family in financial ruin. Everyone needs some type of insurance to protect your life, your ability to earn income and to keep a roof over you and your families head.

Life Insurance is your financial back up plan for your family. It gives you the confidence to seize life’s possibilities knowing you’ve made plans to secure your family’s future.

A Life Insurance payment, which provides a one-off payment in the event of your death or if you are diagnosed as terminally ill, can help your family continue to live the life you’ve planned together. While you want to ensure that you’re adequately protected, there are a lot of insurance policies that are unnecessary for most people. Purchasing the wrong insurance, or simply spending too much on insurance can do more harm than good.

Insurance is incredibly complicated for most people to fully understand. An Insurance Broker can help you to understand the finer details of a policy and also work out what level of cover you need so that you are properly protected.

An Insurance Broker has the experience and specialist knowledge to help you find cover that’s the right fit for your needs. Most importantly, a broker works for you not the insurance companies.

Helping you to understand what is in your policies

When you start thinking about life insurance, odds are you’re thinking about protecting your family both now and in the future. And that’s a great place to start. But life insurance can do so much more. While everyone can benefit from life insurance, you may want to consider one type more than another at different points in your life